FOR LONG TERM PLANNING, BEGIN WITH A PURPOSE IN MIND

Get Your Retirement Income On Track

What is the underlying premise for all long-term savings? Why are we giving up current enjoyment of our income? The answer is to have an income stream in retirement. It makes sense to learn how retirement income streams work economically and define how to allocate your savings today. The sooner you get on an efficient path, the greater the impact you have on your retirement income streams. Let Destination Retirement help today.

The Retirement Income Dilemma

INTERVIEWS FOR RETIREMENT NEWS ONLINE

Testimonials

Learn About Planning

Product vs. Strategy

MIKE SEIBERT ON RETIREMENT

Four Stage of Investments in Retirement

Four Stages of Taxes in Retirement

LOOK INTO YOUR FINANCIAL FUTURE

Want a quick look into your financial future without the hassle of filling out piles of paperwork or sitting through countless hours-long meetings? Use our 9 To Know analysis that takes just nine pieces of your contact and financial information and tells you if you’re on track for the retirement you want. Then, if you aren’t on your way to that picture perfect future, we can help.

Get your complimentary analysis now!

A Thought on Retirement

“Our approach to saving is all wrong. We need to think about monthly income, not net worth.”

Dr. Robert C. Merton

Harvard Business Review Contributor

Economic Sciences Nobel Prize Laureate

Longevity and Distribution Rates

The Two Main Retirement Income Problems

Longevity

Distribution Rates

Determine a distribution rate before knowing the rate of return of our Retirement Assets in any given year.

Most traditional retirement plans show a constant rate of return vs. variable return. How do Retirement Assets react to fluctuating rate of returns? We have no idea what our sequence of returns will be the day we retire. What if your portfolio loses 10-15% in a given year, what is your plan of action for the following year?

Let's Talk Twos

Two Economics Powers® Approach

Investments and Actuarial Science

The key is diversifying where you put your retirement savings. Using these TWO POWERS together can create higher retirement income streams. In doing this, you will create a situation with multiple savings sources. This allows you to withdraw yearly income from different areas in your retirement years from a more stable savings base.

Most people used to get both powers by default through defined benefit pension plans. As defined contribution plans such as the 401(k) and 403(b) became more popular, very few people continued to have the security of a pension plan. It is no longer your employer’s responsibility to fund your retirement. Very little education has been given to individuals regarding what they must do to provide for themselves the day they retire.

Two Pre-Retiree Wealth Building Questions

How much do I need to save?

Where do I need to put it?

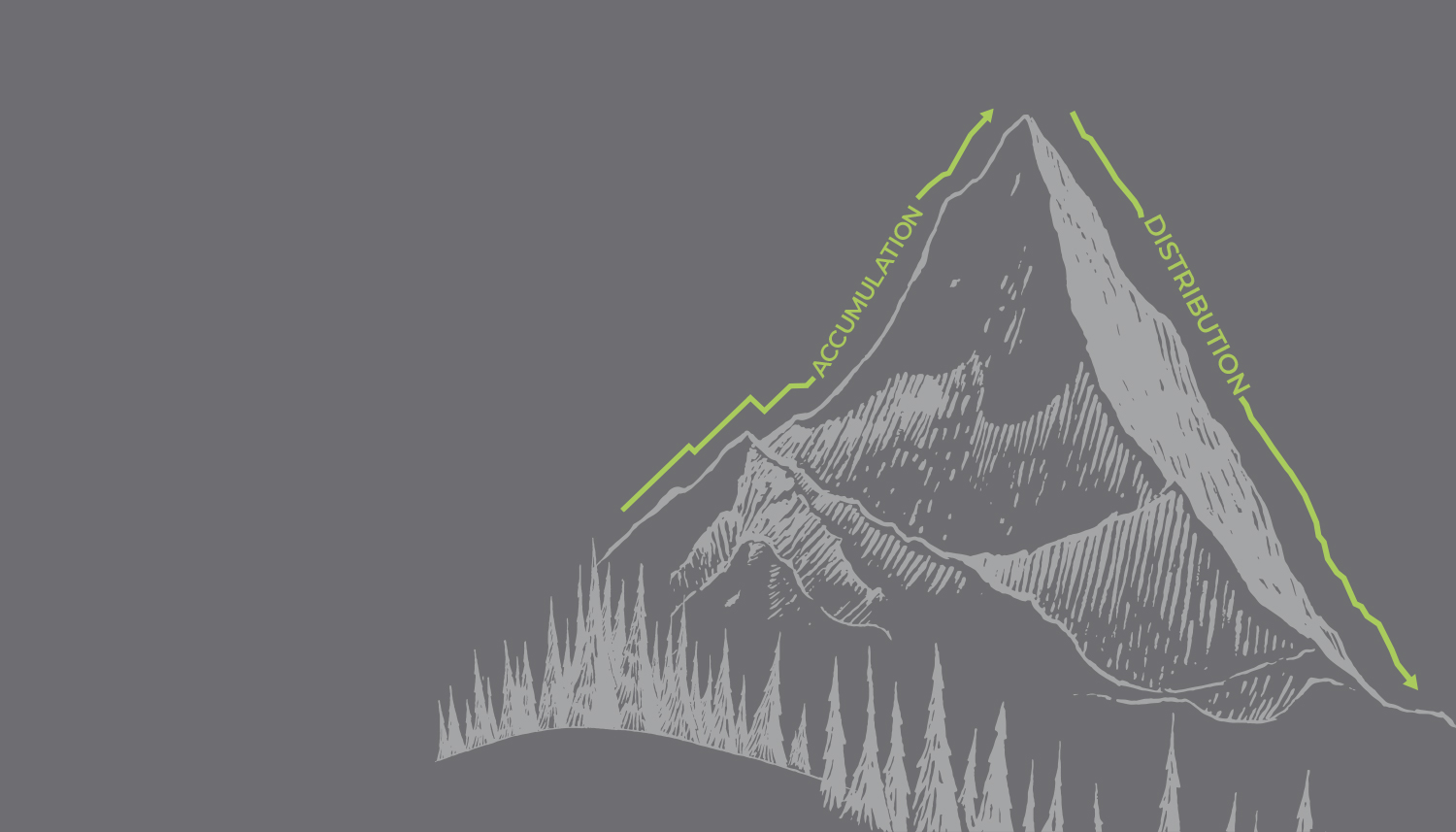

Two Parts to the Climb

Accumulation and Distribution

Think of it like climbing a mountain. What’s the objective? Is getting to the top the objective? Or is it really getting to the top then making it back down safely the ultimate objective? This is a metaphor for our financial lives. Getting up the mountain is our Pre-Retirement/Accumulation phase and getting back down is our Retirement/Distribution phase. The key is this one continuous journey. Understanding how retirement income streams work (distribution) defines “how you pack your bags” in Pre-Retirement.

If you were going to climb a mountain, would you get a guide? What if the guide said they could get you to the top of the mountain, but they weren’t sure how you were going to get back down? Would you continue to use that guide or find another one? Let us be your guide to all things retirement.

Thinking About Retirement Planning

Why is this Strategy So Important?

Longevity

Inefficient losses can be reflected in:

- Lower Current Lifestyle

- Lower Retirement Income

- Inadequate Protection

- Loss of Financial Control

- Financial Vulnerability

- Higher Taxes and Fees

- Less Benefits

Effective Planning

How Significant is Efficiency?

The same individual could create $125,000 a year of retirement income with an efficicent process using the same amount of savings.

Learn About Planning

Inflation's Impact

Let’s say you saved $1,000,000 at the time of your retirement. Traditionally you take out the safe annual withdraw rate, 3-4%, a year which is $30,000 – $40,000. With the inflation adjustment, people who make $100,000 yearly to support their lifestyle today need to be making $180,000 annually in 20 years with 3% inflation.

The Problem with One Economic Power® (Traditional Financial Planning)

The 3-4% Rule

$1,000,000

$30k – $40k

EXAMPLE OF HOW MUCH YOU'LL NEED TO ACCUMULATE IN ORDER TO SUPPORT YOUR LIFESTYLE AT RETIREMENT

With Inflation Adjustment

$100,000

$180,000

For the desired lifestyle of $180,000 and at a 3.5% distribution rate, you will need to accumulate

$5,000,000

How feasible does this path sound running your own numbers? Is this the path you would want to stay on if you had the choice?

PROJECTED ANNUAL RETIREMENT INCOME

Effective Planning

If You're 40 Now

$400,000

$16,500

$2,676,329

$93,671

Effective Planning

If You're 50 Now

Let’s say that your current income is $200,000 a year. At age 65, with 3% inflation, your adjusted income needs to be

$311,593 a year to maintain your current lifestyle.

$1,250,000

$20,000

$3,489,148

$122,120

The problem in many cases isn’t the accumulation of money in retirement plans like 401(k)’s, but the low distribution rates we could be on track for if that’s all we do. What if today you could put yourself on a path that provides higher distribution rates from the retirement assets you’re accumulating? It is possible using our Two Economic Powers® approach.

*Hypothetical illustration may not be used to predict or project investment results.

The Solution

Approach your yearly retirement income with the Two Economic Powers® Strategy.

Comparisons

Two Economic Powers® Examples

- Total Income:

- Amount Guaranteed:

- Approximate Years of Volatility Buffer:

- $174,519 a year

- $0 a year

- -

Two Economic Powers® Strategy

- $376,112 a year

- $340,398 a year

- -

- $374,460 a year

- $0 a year

- 5.4 years

- Total Income:

- Amount Guaranteed:

- Approximate Years of Volatility Buffer:

- Total Income: $174,519 a year

- Amount Guaranteed: $0 a year

- Approximate Years of Volatility Buffer: -

- Total Income:

- Amount Guaranteed:

- Approximate Years of Volatility Buffer:

Two Economic Powers® Strategy

- Total Income: $376,112 a year

- Amount Guaranteed: $340,398 a year

- Approximate Years of Volatility Buffer: -

- Total Income: $374,460 a year

- Amount Guaranteed: $0 a year

- Approximate Years of Volatility Buffer: 5.4 years

What is a volatility buffer?

The system by which an individual can protect their assets in the event of market unpredictability immediately following retirement.

For More Information

Let’s Chat About Your Retirement Income Plan

Just answer a few simple questions to see how well prepared you are for retirement and we’ll get in touch to find the very best plan that fits your lifestyle and financial concerns.

You’ll also receive a complimentary white paper featuring eight core ideas to retirement income planning, written by retirement income expert Dr. Wade Pfau.

Visit Us

Allentown, PA 18104

Email Us

rsnyder@1847financial.com

Call Us

484-275-6035

Visit Us

Allentown, PA 18104

Email Us

Call Us

Direct: (610) 360-8187

Learn About Planning

We Can Help Plan for the Road Ahead.

Resources

Retirement Planning Resource Hub

- What is a RICP® and Why Should You Care?

- Does Your Advisor Have Their RICP® Designation? Find Out Here.

- Inventor of the 401(k) Says He Created a Monster

- Vanguard Retirement Nest Egg Calculator

- Fidelity – A Spending Power with Staying Power

- Eight Core Ideas to Guide Retirement Income Planning

- How Long Can You Expect to Live?

- Retirement Nest Egg Calculator

- Life Expectancy Calculator

Watch the Video to Learn About Retirement Planning With Two Economic Powers®

About

Michael J. Seibert

RICP®, CLU®, ChFC®, CAP®, LUTCF